You work hard. Your money should, too.

Meet the first-of-its-kind wealth manager created for doctors. Start optimizing your wealth potential with someone who gets you. You’ve earned it.

Ongoing Wealth Management

We pair you with a dedicated Earned Advisor who is focused on wealth creation for doctors. Your advisor will apply our Doctor Wealth Playbook to rapidly identify ways to increase your wealth potential and help you achieve your goals.

3-Month Wealth Diagnostic

Partner with your Advisor to assess your financial health across investing, tax planning, insurance, income and debt management, and trust and estate. Our three month engagement will culminate in a financial plan that we'll deliver and you'll execute on.

Personalized to meet your needs

Our Doctor Wealth Playbook is a proprietary process that we use to identify, prioritize, and action wealth creation opportunities for our doctor clients. Over your first 12 months with Earned, we'll do the heavy lifting to unearth opportunities to maximize your wealth potential and help achieve your goals.

Start with a comprehensive, personalized roadmap

Your dedicated Earned Advisor will develop a custom plan that becomes a roadmap from where you are today to where you want to be. Trust that you are getting the best advice – your dedicated Advisor is a fiduciary (they are not paid on commission for anything recommended to you), Certified Financial Planner™ professional, and has the power of modern tax-smart technology behind them.

Map your sources of income and identify your career and personal goals.

Calculate your current net worth, inclusive of student loans, practice ownership, and real estate

Identify key value generation areas

Access innovative investment strategies designed for doctors

Earned’s investment philosophy focuses first on your financial goals as a doctor, then creates personalized strategies factoring in your preferences, financial and tax circumstances, income, personal balance sheet, goals and aspirations.

Tax-smart investment strategies powered by advanced technology

Direct indexing and ESG capabilities for personalized portfolio solutions

Private equity, private credit, and private real estate for accredited investors and qualified purchasers

Get tax-smart strategies to help you keep what you've earned

By taking a holistic view of tax planning in conjunction with investment strategies, Earned can identify ways you may not have considered to help lower your tax bill, generating tax savings that further fund your financial goals.

Minimize your tax burden with smart deductions

Get tax-smart investing strategies tailored to you

Receive professional advice year-round

Maximize your earning potential and career decisions

Earned will arm you with the data and tools you need to navigate your most important career decisions. From evaluating multiple job offers, to considering taking on a side gig, to the preparation needed to buy into or sell a practice - once you decide, we’ll work with you to optimize your financial life around that decision.

Understand the tradeoffs of being an employee versus a practice owner

Understand the benefits and drawbacks of taking on 1099 income such as locums tenens or telehealth

Assess the financial implications of a career change, including selling your practice

Manage risk with the right coverage at the right cost

Constructing an optimal insurance strategy - that balances employer coverage with premium costs and your overall risk - is essential to financial security and your peace of mind. We’ve got you covered.

Determine if you are adequately managing your financial risks with an Earned insurance review

Protect your income with the right life and disability insurance for doctors

Protect your assets with quality, cost-effective property and casualty insurance

Using debt to your advantage

At Earned, we develop personalized debt management strategies to help you avoid the pitfalls of debt and capitalize on its smart uses to help realize the financial outcomes you deserve.

Get personalized advice on optimizing your debt management strategy

Learn about debt forgiveness programs for doctors

Determine how to prioritize debt repayment while funding other financial goals

Feel prepared for every part of your future

At Earned, we understand the importance of connecting your financial goals and decisions to your trust and estate plan - making sure your assets are distributed according to your wishes. We’ll review and visualize your current estate plan, making it easy to understand, and ensuring it’s connected to your financial goals and most up-to-date view of your assets.

Receive a detailed, personalized picture of your estate plan

See the impact of your estate plan in a clear, easy-to-understand format

Determine if changes are needed to your estate plan to match your wishes

From residency to retirement, we’ll help you navigate

Debt Management

Is it a smart financial decision to pay down my medical school loans if I want to buy into the partnership?

Residency

Retirement

Backed by modern, tax-smart technology

Game-changing tech. Unlimited potential.

Our Intelligent Advice Engine™ allows our advisors to deliver robust, precisely-tailored financial advice while they work to systematically optimize outcomes. In our client portal, you will have transparency on what Earned is working on your behalf, and be able to seamlessly reach your dedicated advisor on your schedule.

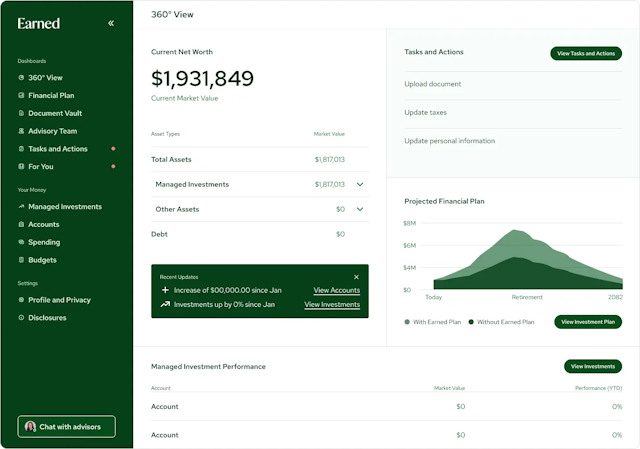

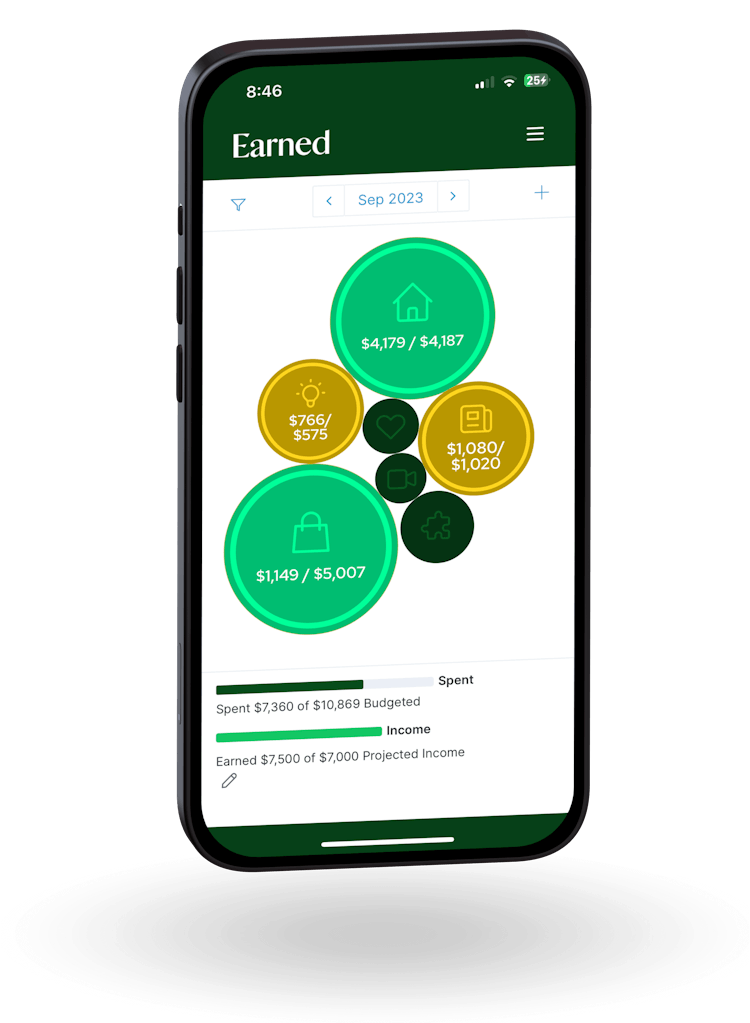

Oversee your wealth in one place.

Through the Earned Wealth App, you will be able to manage your net worth all in one spot, manage your budget, track subscriptions and more!

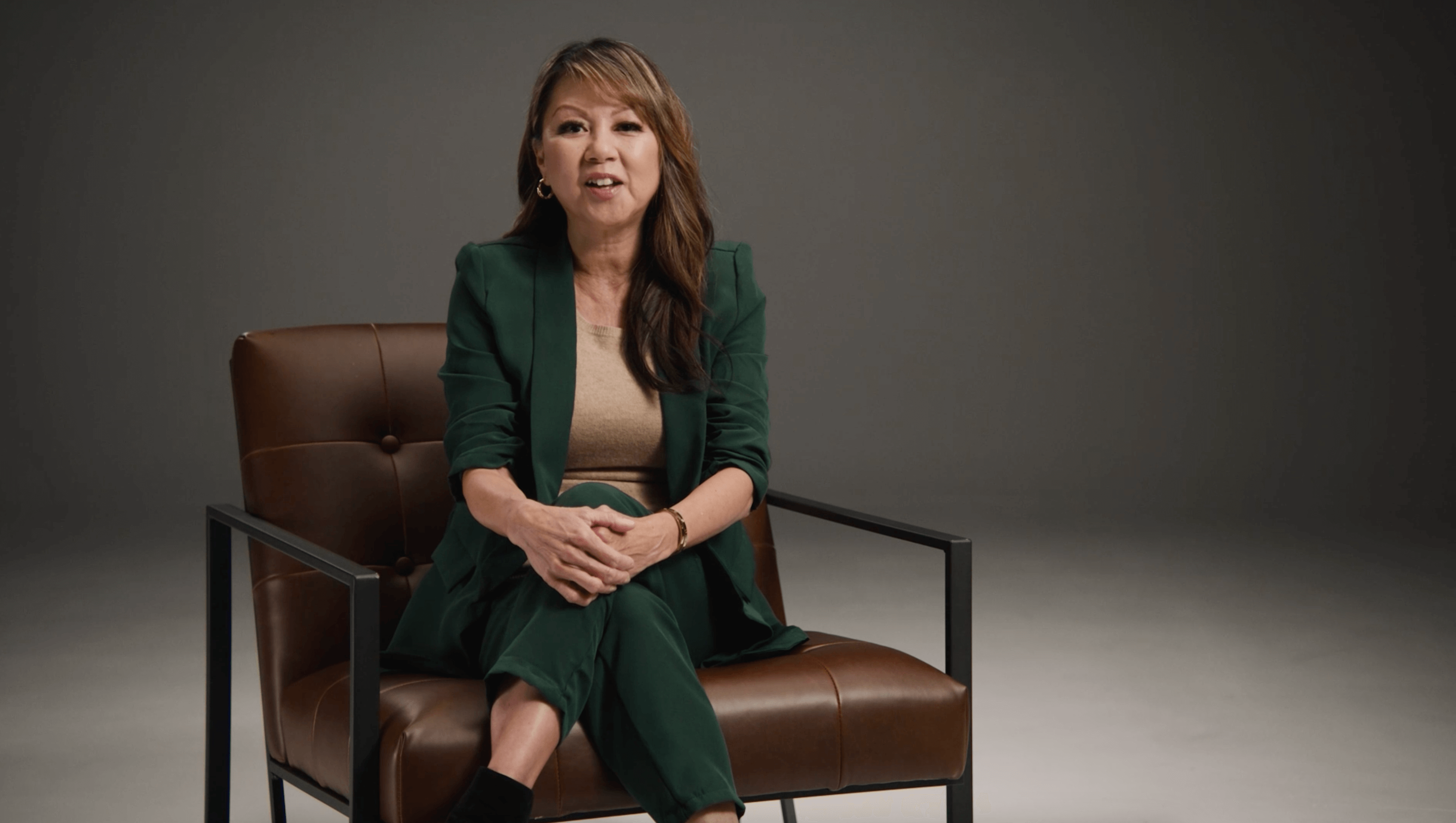

"Doctors are the heroes of our society and they deserve better in their financial life... their money ought to be working really hard. It's never too late to make the changes necessary to optimize your financial life.”

John Clendening

CEO, Earned

Real clients, real praise.

Testimonials provided by current clients. Clients are not compensated for providing testimonials.